Similarly, Potluri et al. (2017) investigated the behaviour and awareness of Muslim students and Indian Muslims towards halal usage in their daily life. In the UK, the House of Commons Standard Note (2012) exposed that there is no legal requirement for food products and services to be labelled as halal. Consequently, halal products are sold without the halal label, and there is little effort to collect data on halal products (Annabi & Ibidapo-Obe, 2017).

In Pakistan, Ali et al. (2018) discovered the inter-relationships between the perceived quality of traditional and halal branding constructs. The study focused on image, trust, satisfaction, and loyalty in predicting halal brand purchase intentions among consumers in Pakistan. In Japan, the involvement of Japanese firms in the halal sector is very low compared to other countries despite challenges in the domestic market (Yusof & Shutto, 2014).

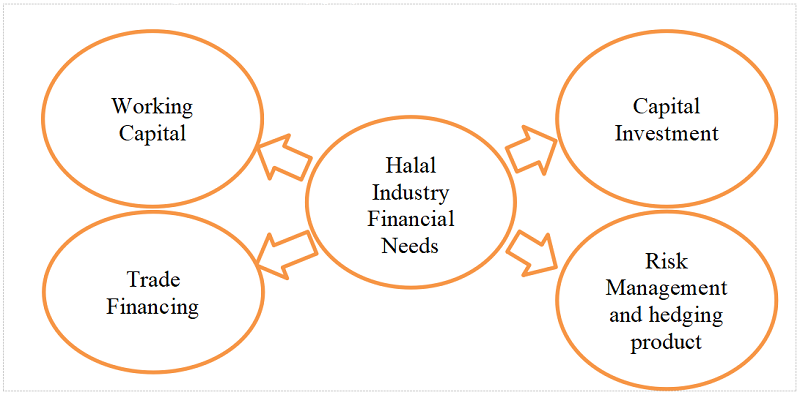

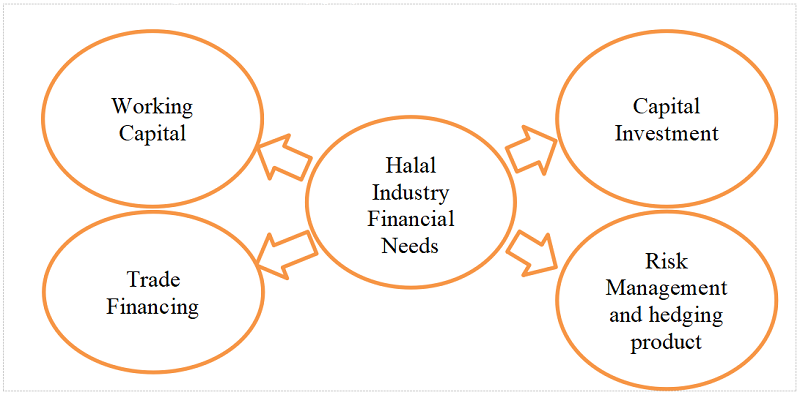

In Malaysia, the halal industry has issues with insufficient SME financing (Dagang Halal, 2018). Several halal businesses have been identified as non-shariah compliant by Shariah screening bodies, owing to their use of conventional financing facilities. There is a financing vacuum for halal companies to be filled by Islamic financial entities with Islamic financing products and services, such as liquidity management, risk management or hedging, capital, investment, working capital, trade finance, and funding (WIEF, 2015). Islamic finance is the right institution for directing surplus funds into dynamic investments and walking into the value chain within the halal economy (MIFC, 2014). Figure 1.1 below illustrates examples of financial needs among halal industry players:

Figure 1.1: Examples of financial needs among halal industry players. Source (MIFC, 2014)

The global halal industry is a multi-national and cross-border business. In recent years, halal businesses have been heavily involved in foreign trade, especially outside the OIC, and exporting to markets with a significant Muslim population. Halal businesses need three types of funding to complete this process: trade financing for funding foreign selling operations, risk control products to mitigate international risks, and operating capital to pay for raw materials and other production costs (MIFC, 2014).

Halal businesses have been using Islamic capital markets to fulfill their funding needs. Sukuk plays a significant function as a funding mechanism for large and medium-sized halal companies to fund debt refinancing, corporate expenses, specialised projects, and acquisitions (MIFC, 2014). This situation may be seen as a capital gain for halal businesses. Shariah enforcement should be implemented in an organisation's supply chain of products and services to ensure a comprehensive halal economy.

According to MIFC (2014), Shariah-compliant financial services will guarantee end-to-end Shariah enforcement in halal suppliers’ activities while supplying them with alternative and ethical financing solutions. The collaboration between the halal industry and Islamic finance will result in a win-win scenario for all parties involved (WIEF, 2015). A genuine halal business should focus on halal production and financing (Ghani, 2013). As part of the halal economy, the halal sector necessitates the incorporation of Maqasid al-Shariah into its business operations, with the primary goal of ensuring moral achievements to promote Islamic traditions rather than maximising profits (Rahman et al., 2017). Similarly, the collaboration between Islamic finance and the halal sector could improve the halal economy, particularly in Malaysia (Muhamed et al., 2014). As a conclusion, Islamic financing products should be used by halal industry players to ensure their operations are fully compliant with Shariah law from the time of raising capital to production.

References

Ali, A., Xiaoling, G., Sherwani, M., & Ali, A. (2018). Antecedents of consumers’ Halal brand purchase intention: an integrated approach. Management Decision. https://doi.org/https://doi.org/10.1108/ MD-11-2016-0785

Annabi, C. A., & Olajumoke Ibidapo-Obe, O. (2017). Halal certification organizations in the United Kingdom: An exploration of halal cosmetic certification. Journal of Islamic Marketing, 8(1), 107–126. https://doi.org/10.1108/JIMA-06-2015-0045

Dagang Halal. (n.d.). Islamic Finance Must Lead the Halal Industry - Halal Articles. Retrieved March 1, 2018, from http://www.daganghalal.com/HalalInfo/HalalArticlesDtl.aspx?id=319

Ghani, B. A. (2013). The CEO CIMB Islamic Speaker Note In The World Halal Forum and World Halal Research Summit,. Kuala Lumpur.

Ireland, J., & Rajabzadeh, S. A. (2011). UAE consumer concerns about halal products. Journal of Islamic Marketing, 2(3), 274–283.

MIFC. (2014). The halal economy: Huge potential for Islamic finance.

Muhamed, N. A., Ramli, N. M., Aziz, S. A., & Yaakub, N. A. (2014). Integrating Islamic Financing and Halal Industry : A Survey on Current Practices of the Selected Malaysian Authority Bodies. Asian Social Science, 10(17), 120–126. https://doi.org/10.5539/ass.v10n17p120

Potluri, R. M., Ansari, R., Khan, S. R., & Dasaraju, S. R. (2017). A crystallized exposition on Indian Muslims’ attitude and consciousness towards halal. Journal of Islamic Marketing, 8(1), 35–47. https://doi.org/10.1108/JIMA-01-2015-0005

Rahman, F. K., Tareq, M. A., Yunanda, R. A., & Mahdzir, A. (2017). Humanomics Maqashid Al-Shari’ah-based performance measurement for the halal industry. Humanomics, 33(3). http://www.emeraldinsight.com/doi/pdfplus/10.1108/H-03-2017-0054

WIEF. (2015). When halal meets Islamic finance. https://wief.org/wp-content/downloads/2016/05/NL14.pdf

Yusof, S. M., & Shutto, N. (2014). The Development of Halal Food Market in Japan : An Exploratory Study. Procedia -Social and Behavioral Sciences, 121(121), 253–261. https://doi.org/10.1016/j.sbspro.2014.01.1126